What's New

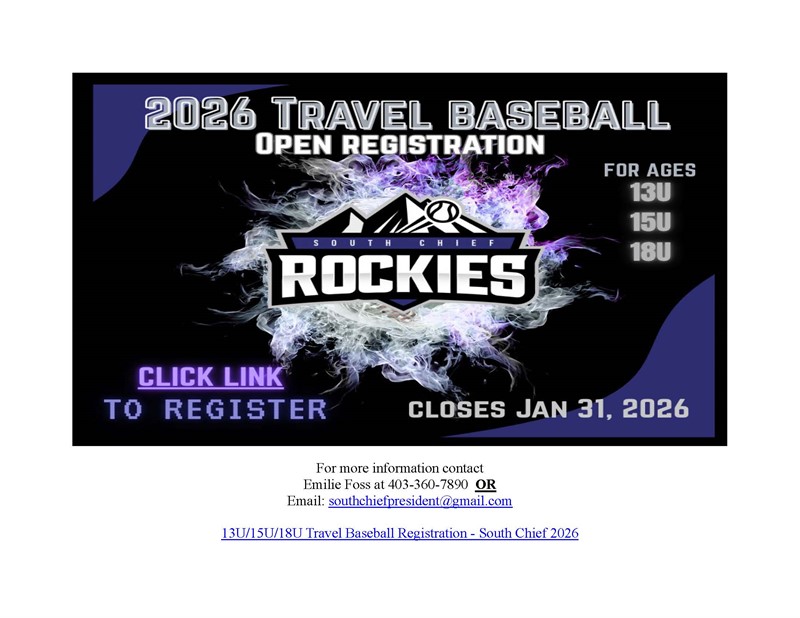

Local Notices

Stirling Alerts

Register today and never miss out on the latest news, upcoming events and emergency information from the Village of Stirling.

Stirling Tourism

Discover the charm of Stirling, Alberta! From historic sites to scenic landscapes, there's something for everyone.

_Web.jpg)

_Web.jpg)